February 2020

Key takeaways from Ripple Street Research’s January 2020 CBD survey:

- 94% of consumers have heard of CBD, and 83% support CBD, but unfortunately 67% of respondents have never tried CBD. Brands need to overcome this awareness gap.

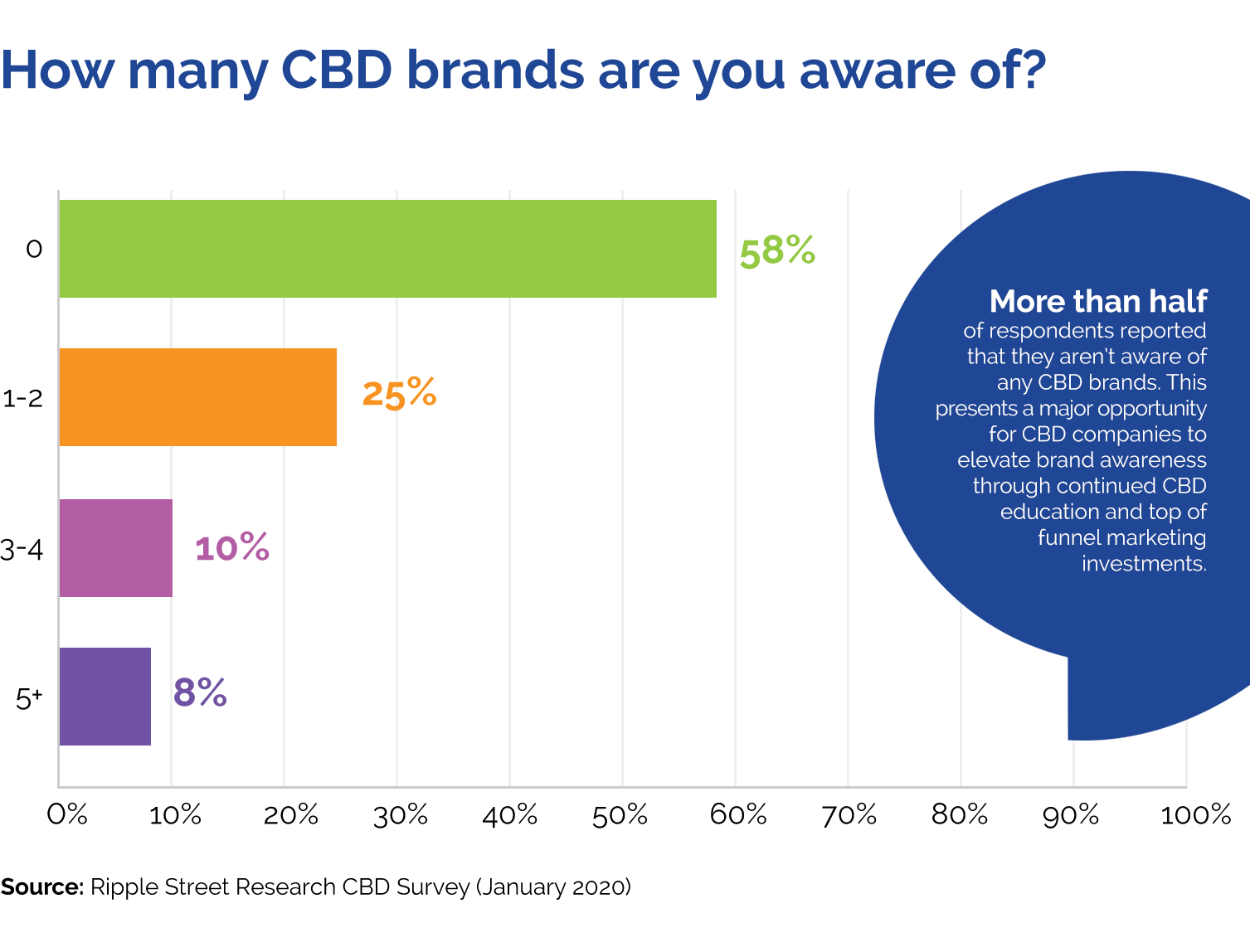

- CBD brand recognition is low: 83% of consumers are aware of two CBD brands or fewer, with 58% not familiar with any brands at all.

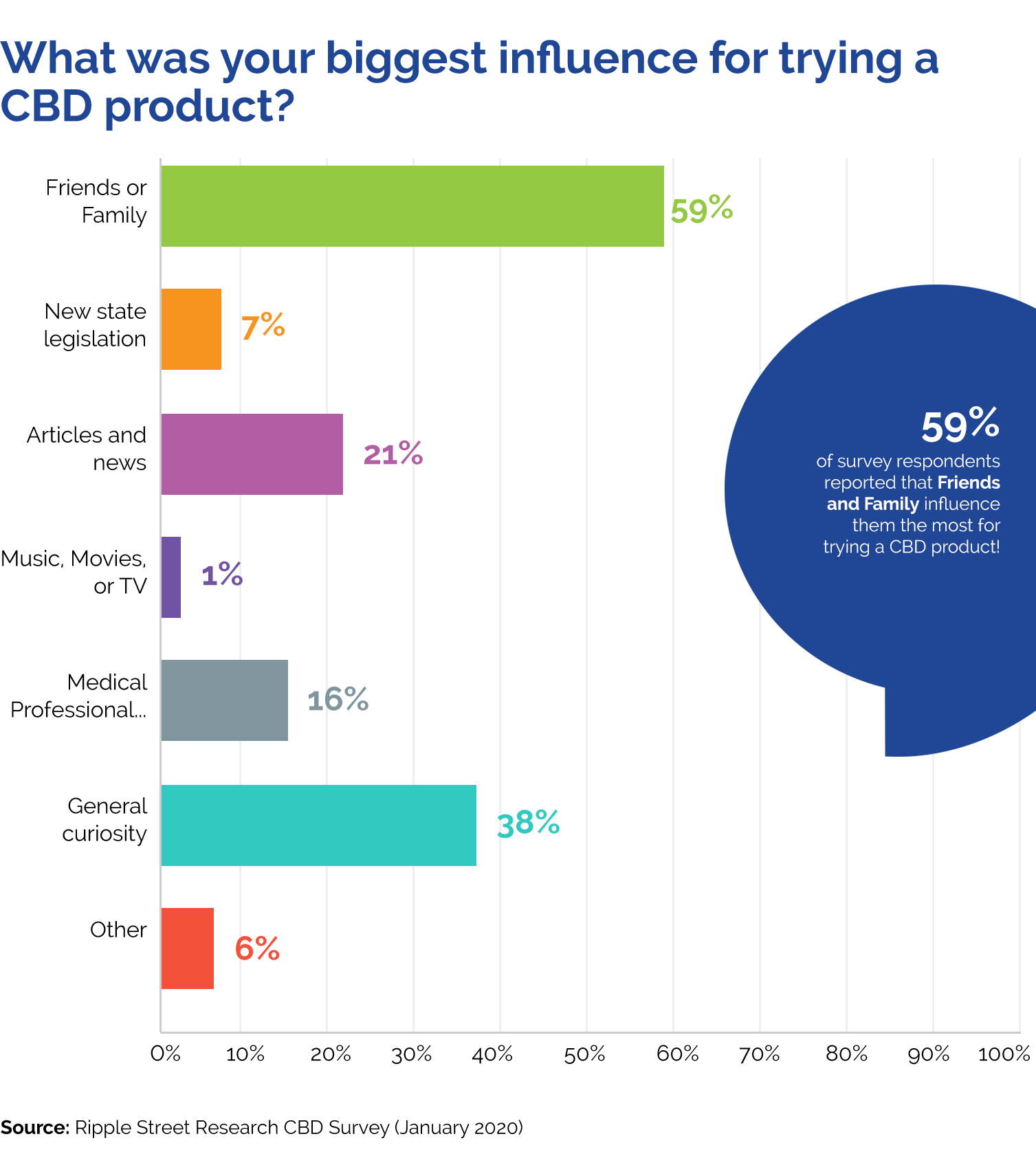

- Friends and family are the primary influence on getting consumers to try CBD, showing brands that word-of-mouth is one of the best ways to educate and expose audiences to their products.

With so much going on in the world, it can feel like we’re getting pulled in several directions at once. Nearly 20% of the U.S. population reports to have an anxiety disorder. Clearly, times are hard, and consumers are eager to find ways to relax.

CBD products have emerged as a popular way to help consumers (and even their pets) unwind and deal with anxiety and pain. And while CBD use and popularity are clearly on the rise, a recent consumer study by Ripple Street found a wide gap between consumer curiosity and actual use.

The results indicated that consumers are very aware of CBD, but they don’t feel educated about the brands, products, and users. This creates a huge opportunity for CBD brands to use community-based marketing techniques to create awareness and educate potential customers.

The awareness gap

CBD, or cannabidiol, has entered the mainstream, according to Consumer Reports, which found that 64 million Americans had tried CBD in some form. Our survey of 35,000 consumers, ages 21 to 75, conducted in January 2020, found an overwhelming 94% of consumers had heard of CBD, and 83% said they support CBD.

But while awareness and support are high, usage trails. Two-thirds of the respondents had never tried CBD. Meanwhile, brand recognition is disappointing: Roughly 83% are aware of two CBD brands or fewer -- 58% are not familiar with any brands at all. Clearly, CBD brands have ground to make up if they want to capitalize on mainstream acceptance.

Strong advocacy

Perhaps the best thing working in CBD’s favor is the fact that many who have tried products find them to be effective. A majority of respondents who had tried CBD said they found it to be effective (78%). The three most common uses were pain relief (72%), anxiety or depression (50%), and as a sleep aid (38%). One respondent went so far as to say that CBD had provided a “life changing result for me.”

With brand awareness so low, testimonials like this can have a major impact. Word-of-mouth is the main driver for consumers to try CBD products, with friends and family inspiring 59% of consumers to try products. Beyond that, general curiosity (38%) and articles and news (21%) spurred our respondents to try products.

Opportunity to educate

Nearly three quarters of respondents expressed interest in learning more about CBD products, and it’s clear that they don’t feel they have many places to turn. While many said that news articles influence a purchase decision, others felt that there wasn’t enough information available. One respondent said they hadn’t tried CBD yet because, “I just don’t know enough about it to make a fair decision on it. Each site I look at to get info varies so I am more confused about it.”

Making things more complex is a lack of visibility in the market. More than half of respondents (54%) said they had not seen CBD products available in any stores, meaning that even those who are curious lack any opportunity to try.

This is where the opportunity emerges. With word-of-mouth such a larger driver of CBD adoption, brand activations done in the comfort of consumers’ own homes have the power to both educate and drive adoption. High curiosity means that brands willing to participate in these efforts are likely to draw interested audiences, something that Ripple Street can help facilitate.

These at-home branded parties, done with family and friends, not only create an environment for education, but one that leads to brand adoption and advocacy. This cuts through the noise of unclear news coverage and helps match curious audiences directly with products, rather than forcing them to search high and low at stores, or feel unsure about an online purchase.

Forming this direct-to-consumer relationship is incredibly helpful for certain categories, such as CBD-infused drinks or food, which 67% of our respondents said they would try, or CBD pet treats, which 48% of respondents were completely unaware of.

At the end of the day, a groundswell of interest and growing support for legalized cannabis is paving the way for CBD products to become part of American’s everyday lives. For brands to seize the opportunity, they’ll need to connect directly with these interested audiences, provide educational resources, and create direct exposure to their products in a setting that captures a word-of-mouth feeling.

Survey methodology

This respondent group was composed of consumers ages 21 to 75, with 5,000 respondents from 12 recreationally legal cannabis states, 20,000 from across medically legal cannabis states, and 10,000 from 13 only-CBD legal states.